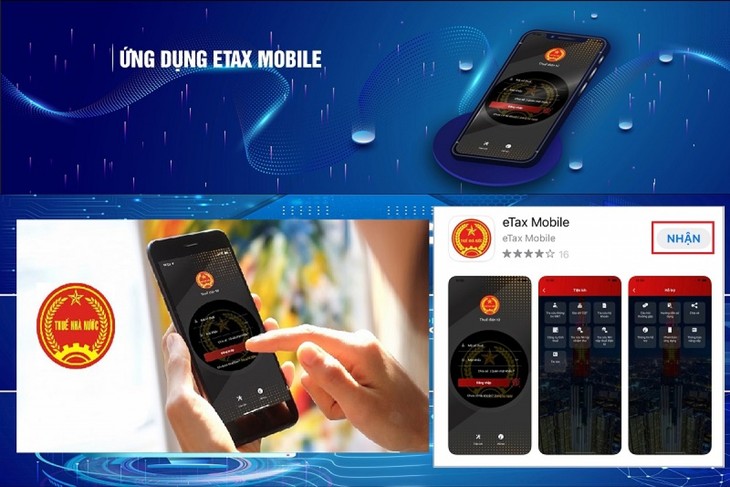

(VOVWORLD) - eTax-mobile, an electronic tax service app for mobile devices, helps individuals and businesses pay taxes conveniently and easily. The app is timely with the Government pushing cashless payment. It fits neatly into the Party and Government’s plan to digitalize all financial and tax management.

(Photo credit: General Department of Taxation) (Photo credit: General Department of Taxation)

|

For years the Ministry of Finance and the tax sector have been using IT to make it easier for businesses and individual taxpayers to fulfill their tax obligations.

According to Pham Quang Toan, Director of the Department of Technology of the General Department of Taxation, “Since 2009 the General Department of Taxation has provided many electronic services, including electronic tax declaration, registration, refunds, and electronic invoices, that have been well received and eagerly used by the business community.”

“eTax-mobile was created to further facilitate tax payments, especially for individuals who are always on the go, and for businesses at locations where normal computer use is not convenient,” Toan said.

To pay taxes electronically, the eTax-mobile system must be connected to a participating bank (currently Vietcombank, Vietinbank, BIDV, MB Bank, and Agribank) that accepts tax payment via e-wallet.

According to Mr. Toan, “Pursuant to the Government’s direction on cashless payments and the Finance Ministry’s development direction, we are continuing to sign up the remaining 49 banks for electronic tax payment. Soon, any individual with an account at one of the 54 banks can pay his taxes electronically using eTax-mobile. This will make it possible for the banks to provide added value for their customers.”

99% of all Vietnamese enterprises use electronic tax services, but the proportion is much lower among individuals. eTax-mobile will make things easier for individual taxpayers by running on the iOS and Android mobile platforms.

The app allows users to register an e-tax transaction account with the tax authority; monitor tax obligations such as personal income taxes, value added taxes, registration fees, agricultural fees, and government fees; pay taxes through a commercial bank; and look up tax information.

The first group to benefit from eTax-mobile will be self-employed individuals, business households, and individuals offering houses for rent. A second group will be individual taxpayers with wage or salary income. A third group will be individuals with income from non-agricultural land. People will also be able to pay registration fees for cars and motorbikes using eTax-mobile.

Mr. Toan further elaborated, “The app can help individuals look up information on financial obligations related to land. Payment through the app is integrated with the national public service portal. We are coordinating with People's Committees to integrate the app into their single-door services to better serve taxpayers who are doing other land-related procedures."

The Taxation Department says that eTax-mobile will give the 60 million individuals who have tax codes easy access to related administrative procedures and help them communicate with tax authorities from wherever they are.