(VOVWORLD) - Data from the Asian Development Bank (ADB) shows that Vietnam's bond market recorded the highest growth rate in emerging East Asia in quarter 2, thanks to growth in government and corporate bonds.

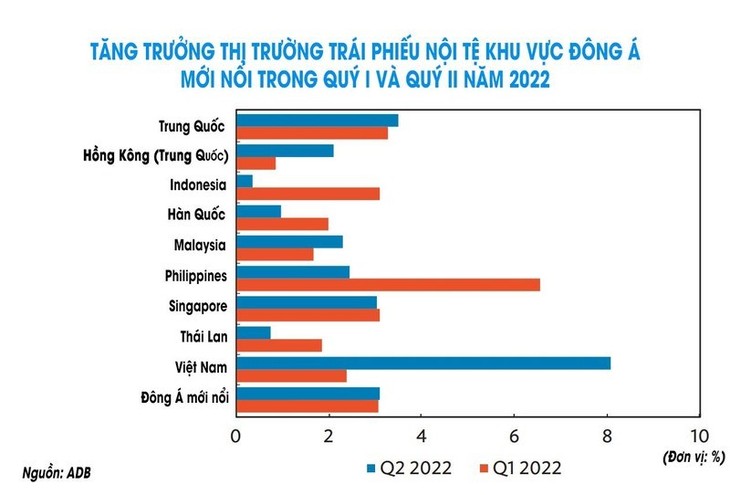

Local currency bond market growth in emerging East Asian countries and territories in Q1 and Q2 2022. (Photo: tapchitaichinh.vn) Local currency bond market growth in emerging East Asian countries and territories in Q1 and Q2 2022. (Photo: tapchitaichinh.vn) |

The Asia Bond Monitor report released last Wednesday said Vietnam’s local currency bond market grew 8.1% from the previous quarter to 99.5 billion USD from June 16 to August 24, the highest increase among emerging East Asian countries and territories. The Vietnamese market increased 31.6% in the second quarter against the same period last year, the highest rate in the region.

Government bonds increased 7.4% from the previous quarter, driven by growth in central bank bills, to nearly 70 billion USD. Corporate bonds climbed 9.5% from the previous quarter to about 30 billion USD, driven by hefty issuance.

Emerging East Asia comprises China, Hong Kong (China), Indonesia, the Republic of Korea, Malaysia, the Philippines, Singapore, Thailand, and Vietnam.

The region’s bond market saw record-high issuance in the second quarter of this year, driven mostly by China’s efforts to stimulate the economy. Regional bond stock rose to 22.9 trillion USD at the end of June. Issuance in economies belonging to the Association of Southeast Asian Nation (ASEAN) rose 10.3%, expanding the bloc’s share of regional bond issuance to 17.5%.

Government bond issuance jumped 25.9% from the previous quarter, as governments borrowed to support economic recovery. Outstanding government bonds reached 14.5 trillion USD, according to the ADB report.